Multiple Sclerosis is a very expensive disease. According to a 2016 study in the American Journal of Managed Care, treating it can cost patients anywhere from $30,000 to $100,000 per year, which can meet or even exceed the average US household median income, depending on how severe your case is. For a disease that has no known cure, and requires frequent medical attention to manage symptoms that can completely debilitate a person if left untreated, that can mean spending $4.1 million over the course of a lifetime, according to the same study.

MS is a disease in which the insulating sheaths of nerve cells, which are made of a protein called myelin, become damaged, and is believed to be caused by an overactive immune system. Symptoms include, but are not limited to, severe fatigue, heat sensitivity, compromised vision and intense pain. Some patients with severe cases find themselves unable to work or even perform basic life functions. Initial symptoms are frequently misdiagnosed by doctors, and a correct MS diagnosis can sometimes take years to happen. Generally, doctors can identify the disease through lesions that appear in brain scans.

Much of that money is spent on prescription drugs, which have seen price increases, across the board, that have outpaced the inflation rate for years. However, the numbers for MS drugs on public insurers are particularly staggering.

Out of 15 different MS-related prescription drugs filled using Medicaid from 2012 to 2016, 11 have increased in price faster than the average rate for all Medicaid drugs: 5.74 percent each year, or 23 percent over that entire period.

For Medicare Part D, the part of Medicare that covers prescription drugs, the increases are similarly exponential: 13 out of 15 MS drugs have outpaced Part D’s overall average rate of 2.4 percent each year.

While the publicly available pricing data only covers part of this decade, prices have been trending upward like this for over 20 years. According to a 2015 study published in Neurology, a medical journal, MS drug prices have been increasing “at rates 5 to 7 times higher than prescription drug inflation” since the 1990s. First generation therapies, which first came to market in the 1990s with annual costs between $8,000 and $11,000, now cost over $60,000 per year.

But why do MS drugs keep getting so much more expensive? Several theories abound.

“In the MS space, there’s not been a whole lot of generics, up until recently. The third medication available for MS in the US is a drug called Copaxone. Its generic is glatiramer acetate. It now has several generic versions available in the United States,” said Kathy Costello, a registered nurse and the Associate Vice President of Healthcare Access at the National MS Society.

“There’s no other generics in the United States for any of the other 14 MS medications. There will be, but some of them are biologic, so their manufacture is significantly different than a small molecule, which would be more like a pill,” Costello added.

A single dose of Copaxone, which its manufacturer, Teva Pharmaceuticals, advertises as “the #1 prescribed therapy for relapsing MS in the US,” cost an average of $380.25 under Medicaid in 2016, up from $135.46 in 2012. Copaxone can be taken as a daily 20mg injection or as a thrice-weekly 40mg injection. According to Neurology, when it first hit the market in 1997, a year’s worth of prescriptions cost an average of $8,292. Now it’s over $60,000.

For thousands of patients like Beverly Golin, 44, a former administrative assistant from Arizona, and Joanna Lacy, a school counselor from Kingston, New York, much of that cost is shouldered by a mix of insurance and copay assistance, like Teva’s own Shared Solutions program. Both have taken Copaxone for years, but they’ve recently been effectively forced by their insurers to switch to a generic version.

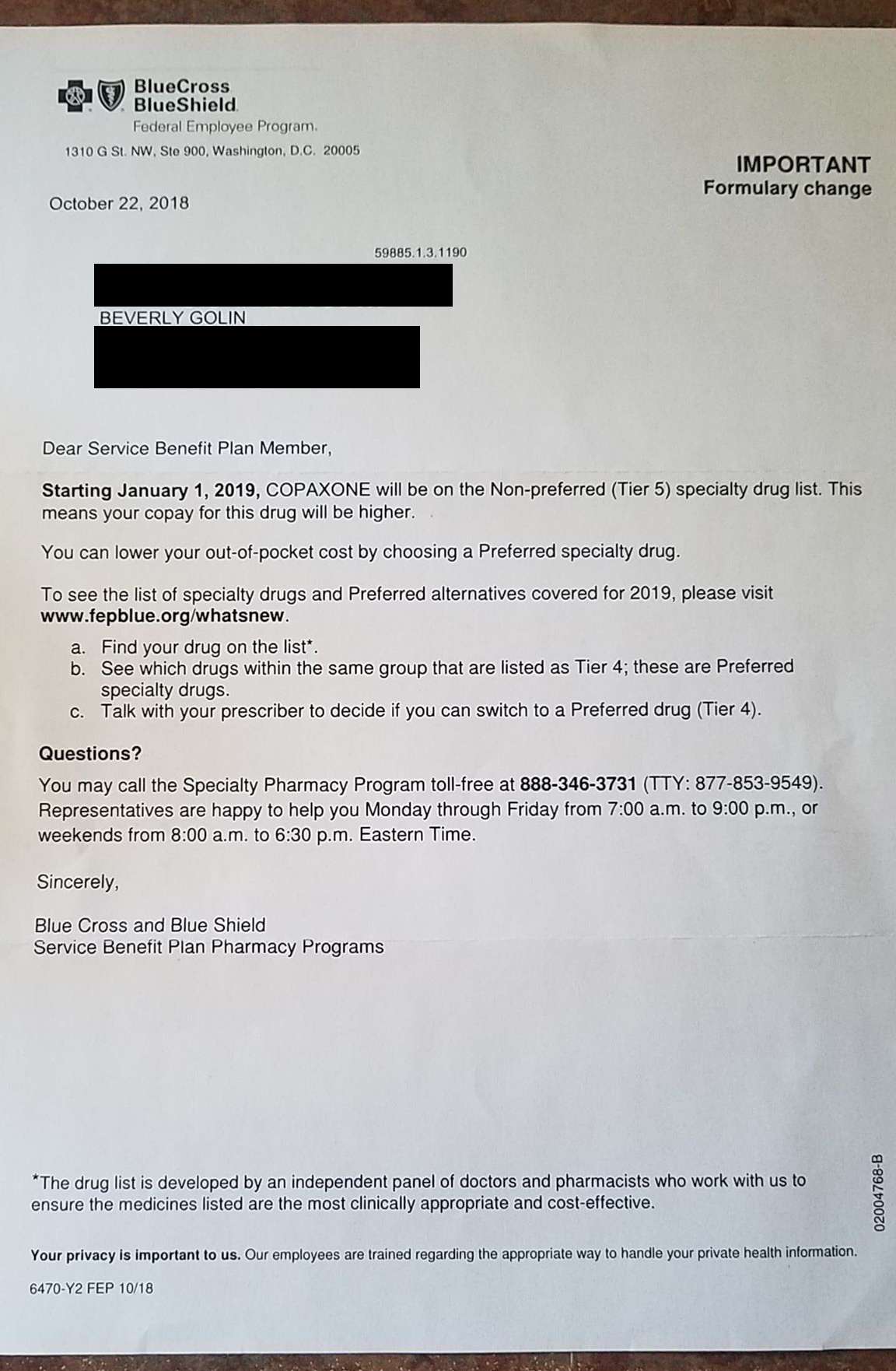

Golin’s insurer, BlueCross BlueShield’s federal employee program, informed her in an October 2018 letter that Copaxone would be demoted to a lower coverage tier, meaning that they wouldn’t shoulder nearly enough of the cost for her to afford it. Lacy learned that she had to switch to a generic when she was told, while filling her prescription in November, that she had maxed out her $12,000-per-year copay assistance from Shared Solutions. Before that, she had never had to pay for the drug out of pocket; her insurer and her husband’s insurer previously kept her annual copay well below that $12,000 mark.

“I’ve never seen a bill for the Copaxone, but Shared Solutions has always covered it, and I assumed they covered it for everybody,” said Lacy. “I just didn’t know any better, I never really saw how much my copay was, how much the medication was per month.”

Generic drugs, which can cost substantially less than their brand-name counterparts once their initial patents expire, often provide substantial financial relief for patients, although in many cases, they’re still prohibitively expensive.

Glatopa, a version of Copaxone made by Sandoz, a major generics manufacturer, has hovered consistently around $160 per dose since it was introduced in 2015, for both Medicaid and Medicare Part D patients.

That number, however, may be artificially low. The thrice-weekly version of Copaxone has become substantially more popular with patients than the daily version over the past few years, and a similar version of Glatopa was only approved by the FDA in February 2018. Medicare data also shows that annual spending on Glatopa, per beneficiary, nearly doubled from about $16,000 in 2015 to just under $30,000 in 2016.

| Brand Name | Generic Name | Manufacturer | 2012 | 2013 | 2014 | 2015 | 2016 | Total Pct Change |

|---|---|---|---|---|---|---|---|---|

| Copaxone | Glatiramer Acetate | Teva Neuroscience | $36,286.03 | $40,858.05 | $45,477.20 | $50,048.39 | $53,127.75 | 46.41% |

| Gilenya | Fingolimod HCl | Novartis | $36,018.47 | $43,353.35 | $47,881.70 | $53,746.40 | $61,002.14 | 69.36% |

| Betaseron | Interferon Beta-1b | Bayer,Pharm Div | $32,197.74 | $36,751.65 | $41,025.26 | $49,719.18 | $56,024.50 | 74.00% |

| Avonex | Interferon Beta-1a | Biogen-Idec | $32,787.28 | $36,742.91 | $42,036.75 | $47,525.83 | $52,979.22 | 61.58% |

| Avonex | Interferon Beta-1a/Albumin | Biogen-Idec | $27,296.80 | $31,454.35 | $37,370.73 | $39,044.62 | $46,237.01 | 69.39% |

| Tecfidera | Dimethyl Fumarate | Biogen-Idec | $19,516.15 | $37,281.99 | $46,578.54 | $53,126.05 | 172.22% | |

| Plegridy Pen | PEGinterferon Beta-1a | Biogen-Idec | $7,250.32 | $32,772.17 | $44,271.46 | 510.61% | ||

| Rebif | Interferon Beta-1a/Albumin | Emd Serono, Inc | $32,473.26 | $38,246.03 | $45,086.69 | $51,283.28 | $57,648.49 | 77.53% |

| Plegridy | PEGinterferon Beta-1a | Biogen-Idec | $6,202.41 | $25,315.52 | $40,429.97 | 551.84% | ||

| Aubagio | Teriflunomide | Sanofi-Aventis | $5,327.20 | $21,769.13 | $35,452.26 | $42,269.34 | $48,587.38 | 812.06% |

| Rebif Rebidose | Interferon Beta-1a/Albumin | Emd Serono, Inc | $20,116.42 | $35,493.02 | $43,283.75 | $50,116.24 | 149.13% | |

| Extavia | Interferon Beta-1b | Novartis | $22,012.20 | $22,724.63 | $27,913.80 | $32,175.72 | $35,301.78 | 60.37% |

| Avonex Pen | Interferon Beta-1a | Biogen-Idec | $34,846.35 | $55,047.12 | 57.97% | |||

| Tysabri | Natalizumab | Biogen-Idec | $12,966.99 | $35,367.12 | $39,316.44 | $44,256.05 | 241.30% | |

| Glatopa | Glatiramer Acetate | Sandoz | $16,193.82 | $29,727.89 | 83.58% |

While some patients have expressed concern about potential side effects associated with switching from brand name Copaxone to a generic, Glatopa has been approved by the FDA as bioequivalent to Copaxone. However, the inconvenience and financial uncertainty that comes with being forced to switch drugs can be tremendously stressful for the MS patients who need them to live.

The authors of the Neurology study more willing to attribute the staggering price increases to the same issue that has kept American medical care as expensive as it is across the board: a lack of government regulation.

“Costs of MS [disease-modifying therapies] are substantially higher in the US market than in the other countries we highlight, suggesting the dramatic increases in costs in the United States are not demanded by increases in manufacturing costs or other changes out of the control of the pharmaceutical industry.” As of 2014, Copaxone costs just under $15,000 per year in Canada, while in the UK, it’s as low as $11,000.

For MS specifically, the oldest drugs available on the market have been sold for a little over two decades, and in the United States, drug patents expire 20 years after the drug’s invention. Once those patents expire, cheaper generics generally begin to appear.

But drugs for a disease that requires as much specialized care as MS are particularly susceptible to various forms of price fixing, given the relatively small number of options available.

This can manifest itself as a practice called “evergreening,” in which patients are encouraged to switch to stronger doses that keep them physically dependent on the more expensive brand-name version. The thrice-weekly 40mg dose of Copaxone was only approved in 2014, the same year its patent expired, and four years before the equivalent version of Glatopa hit the market.

But what’s arguably even more important is that many of the MS drugs on the market aren’t interchangeable. The number of drugs available for MS is limited, and their tolerance profiles, side effect profiles and the mechanisms by which they treat symptoms vary substantially. What’s good for one patient might be terrible for another, and if those patients only respond well to one or two different drugs, then they’re not really competing against each other on the open market. They just just exist in parallel to each other, with nothing really there to keep prices down.

“It is a dysfunctional market that they can price drugs pretty much whatever they want to,” said Daniel Hartung, an associate professor at Oregon State University’s College of Pharmacy, and the lead author of the Neurology study. “The strategy, I think, has been: we price our drug at a level that’s essentially what everyone else is pricing it at, and probably give it a 5 to 10 percent premium, but don’t make it stand too much above what the other drug companies are pricing it at. There’s no reason to undercut everyone on price.”

In the case of Erin, an MS patient who requested that her last name not be published, Tysabri was a “wonderful drug” for her, until her doctor told her that it gave her above-average odds of contracting progressive multifocal leukoencephalopathy, a potentially fatal brain infection. She now uses Copaxone, but will likely switch to a generic when her insurance ceases to cover the brand name version at an affordable rate.

Similarly, Golin previously switched to Copaxone from Avonex, because Avonex was giving her several particularly harmful side effects. Avonex and Tysabri are both immunosuppressants, and seek to mitigate MS symptoms by weakening the reducing the immune system’s ability to carry out its functions, including, but not limited to, attacking nerve cells. On the other hand, the active ingredients in Copaxone and its generics are myelin proteins, which experts believe serve as a kind of decoy for an overactive immune system to attack instead of the myelin sheaths on nerve cells.

Teva Pharmaceutical

Copaxone, the most widely-used MS drug in the world, is manufactured by Teva Pharmaceutical Industries, Ltd, an Israeli firm that's publicly traded on the New York and Tel Aviv stock exchanges, with its American headquarters located just outside of Philadelphia.

In 2015, Copaxone accounted for roughly half of Teva's profits, and 20 percent of its revenue. That same year, Glatopa, the first generic version of Copaxone, produced by Novartis-subsidiary Sandoz, received FDA approval. Facing a threat to its profit margins, Teva has worked diligently to protect their brand-name Copaxone's financial viability.

Teva introduced its 40mg version of Copaxone in 2014, which patients have to take three-times a week, instead of the original 20mg version's daily doses. That process, known as evergreening, is controversial in the medical community, as it forces patients to stick with more expensive brand-name drugs after generics are introduced, or else risk physical side-effects.

Since 2014, Teva has also sued several generic manufacturers who have attempted to produce their own versions of glatiramer acetate. In 2015, the Supreme Court ruled 7-2 in favor of Teva in their lawsuit against Sandoz, reversing a lower court decision, and upholding several of Teva's Copaxone patents. Glatopa's 40mg version hit the market in early 2018, and in October of that year, Mylan N.V., a Dutch pharmaceutical, won their case against Teva, invalidating several of its patents related to the 40mg version.

The letter Beverly Golin received from her insurer, BlueCross BlueShield's federal employee program, informing her that Copaxone would be moved to a lower prescription tier, substantiallly raising her copay. (Courtesy of Beverly Golin)

While it remains to be seen if prices for MS drugs will eventually level off in the United States, the authors of the Neurology study are less than optimistic.

“Barriers and regulatory loopholes make economic relief in the form of generic competition unlikely in the near future.” But what could, eventually, deliver that economic relief?

In the United States, Medicare is legally barred from negotiating prices with drug makers in the way that private insurers are allowed to, despite the fact that Medicare is one of the country’s largest healthcare providers. That artificially drives drugs prices up across the country.

Unlike Medicare, the Department of Veterans Affairs is legally allowed to negotiate prices with insurers, and for 2014, Copaxone cost about $34,000. That’s still noticeably more than in the UK or Canada, but substantially less than under Medicare.

Hartung is also optimistic about last year’s introduction of Ocrevus, a drug manufactured by Roche with “really strong efficacy data” and priced about “25 to 30 percent lower” than its existing competitors.

Beyond that, the only thing that might be depressing prices is public pressure. Raising prices on drugs for people who need them to remain alive looks bad, and Hartung believes pharmaceuticals, ultimately, are cognizant of this.

“In the late 2000s and the early 2010s, price increases were almost regularly over 10 to 15 percent a year, and now they’re starting to slow down a little bit,” Hartung said. “I think a lot of that is because of the bad publicity and the bad publicity pharma’s been taking on this.”

Multiple Sclerosis affects an estimated 2.3 million people worldwide, including an estimated 1 million in the United States. MS is frequently misdiagnosed, and a positive diagnosis can occur years after a patient experiences their first symptoms. If you or a loved one has MS, the National Multiple Sclerosis Society offers resources, information and support.